Your Credit Card Account Is Scheduled To Be Closed! Scary heading to see when you open your email. Recently I received this message in the subject line from my bank. It reminded me why managing our credit cards is so important in this points and miles game.

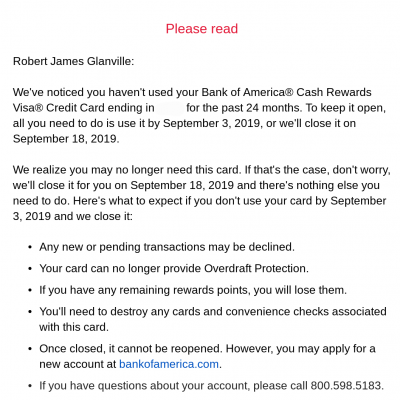

Bank Of Americas Warning Letter

How I Keep Credit Cards Organized

Organization is key. In this travel hacking hobby or simply day to day life. I use Google calendar to keep all my general reminders in check. It syncs my computer and phone so I can access it any time, any where. I’ll also use Google Docs for spread sheets to keep track of credit cards and loyalty programs like hotels, airlines, car rental etc.

My credit card spread sheet has these columns.

- Date I applied.

- Date I actually got approved. This is the date the bank starts the clock on you getting your sign-up bonus.

- What was the sign up bonus?

- Date the minimum spend is due to get the bonus.

- Did I set up auto pay?

- Date the annual fee is due.

- Was there a retention offer? If so, what was it? Just before the annual fee due date, I’ll call in to see if there is a retention offer to have the annual fee waived or get some kind of incentive to keep the card open.

- Date if I ever downgraded or cancelled the card.

How I Categorize Our Credit Cards

Over all cards go into different piles.

- Your everyday spenders. The ones you use the most and have a permanent place in your wallet.

- The ones that come out for special occasions. For example, there is a special spend offer. Spend ‘X’ at ‘store Y’ and get ‘Z’ bonus. Or you’ll be staying at the hotel, or flying an airline that you have a co-branded card at.

- The dog pile. This is where cards go to sleep. After the romance of the initial sign up bonus the card’s pretty much dead to you. It may be a no annual fee card so sitting in your sock drawer is still helping your credit score history. Or maybe it has an annual perk that justifies the fee like a free hotel night stay or a certain amount of points.

Although the third example sounds easy, there is one step needed.

Buy Something At Least Once A Year

The key thing to managing several credit cards is to spend something, at least 1x-2x a year. If a bank feels you are not using the card they may just cancel it. With or without warning.

This happened to me with Citi bank. I had a Citi ThankYou Preferred credit card closed without warning. I simply received an email stating ‘due to inactivity, blah blah, we closed your account’.

This really sucked because I was working on a future application strategy at the time. Citi has a rule that you can’t get a sign-up bonus on a new card if you ‘opened’ or ‘closed’ an account within the same family of reward points within the past 24 months. There was no wording ‘or currently have open’.

The Preferred card is part of the ThankYou Points rewards. I wanted to apply for the Citi Premier card with a 60K TYPoint sign up bonus. Checking my spread sheet, I saw I had 2 months left before the 2 year anniversary that I received the Preferred signup bonus. I would have been eligible but since Citi ‘closed’ the account, it reset the clock for another 2 years before I could get a TYPoint bonus again. Grr!

Wrap Up

I’m not a very organized person by nature but in this points and miles hobby I have to be. Several times I’ve learned the hard way why managing our credit cards is so important. Over all, I’m glad that I received this email from Bank Of America. I now have a choice on what to do as opposed to being “cancelled”. Having choices is a good thing. Therefore in the future, I will probably do a spend at least once a year and keep all of our credit cards open. Have you ever been involuntarily axed by a bank? Would love to hear your experience. As an aside do you want to know how to have a good credit score while earning points and miles in this travel hacking game?

2 Comments